Introduction

Property tax serves as a crucial revenue source for local governments, funding essential services such as schools, roads, and public safety.

It is typically levied based on the assessed value of a property, with rates varying by jurisdiction.

Understanding the intricacies of property tax is vital for homeowners, as it directly impacts their financial obligations and long-term planning.

Delving deeper into the realm of property tax unveils its significance in shaping homeownership costs and investment decisions.

By comprehending how property tax assessments are determined and how rates are set, individuals can make informed choices about purchasing, owning, and improving real estate.

Failure to grasp these concepts may lead to unforeseen financial burdens or missed opportunities for tax savings.

The relationship between property tax and home improvements is multifaceted.

On one hand, making upgrades or renovations to a property can potentially increase its market value, thereby raising its assessed value for tax purposes.

While enhancing the aesthetic appeal or functionality of a home is desirable, homeowners must consider the implications on their property tax liability.

Strategic improvements that yield a high return on investment may outweigh the associated tax implications.

Conversely, certain home improvements may qualify for tax incentives or exemptions, offering relief from property tax burdens.

For instance, energy-efficient upgrades or renovations aimed at improving accessibility for individuals with disabilities may qualify for tax credits or deductions.

Understanding these provisions can incentivize homeowners to invest in sustainable or inclusive home improvements while mitigating the impact on their property tax bills.

In summary, the interplay between property tax and home improvements underscores the importance of a comprehensive understanding of both concepts.

By navigating this dynamic landscape with knowledge and foresight, homeowners can effectively manage their financial obligations, enhance their properties, and contribute to thriving communities.

Transform Your Real Estate Decisions

Unlock personalized real estate insights crafted just for you. Get actionable advice designed to amplify your success.

Get StartedOverview of Property Tax

Definition of property tax

Property tax is a recurring tax imposed on the owners of real estate properties.

It is typically collected by local governments, such as municipalities or counties.

How property tax is calculated

Property tax is usually calculated based on the assessed value of a property.

The assessed value is determined by assessing authorities, taking into account factors like market value and property improvements.

A tax rate, set by the local government, is then applied to the assessed value to determine the actual tax amount.

Factors that influence property tax rates

- Location: Property tax rates vary from one jurisdiction to another.

- Property value: Higher-valued properties often face higher tax rates.

- Property type: Different property types may have different tax rates, such as residential, commercial, or agricultural properties.

- Local budget needs: Local governments may adjust tax rates to meet budget requirements.

- Exemptions and deductions: Some jurisdictions offer tax exemptions or deductions to certain property owners, such as seniors or veterans.

- Improvements and renovations: Home improvements can increase the assessed value of a property, leading to higher property tax.

Understanding property tax is crucial for homeowners, as it impacts their expenses and financial planning.

By comprehending the factors that influence property tax rates, homeowners can make informed decisions regarding home improvements.

Property owners should consult their local authorities or tax professionals to ensure accurate understanding and compliance with property tax regulations.

Properly documenting home improvements can help homeowners support their property’s assessed value in case of disputes.

Regularly reviewing property tax assessments and understanding the calculation methods can prevent overpayment or incorrect tax assessments.

In essence, property tax is an important aspect of homeownership that influences expenses and financial planning.

Understanding its definition, calculation methods, and the factors that influence tax rates is essential for property owners.

By staying knowledgeable and proactive, homeowners can effectively manage their property tax obligations and make informed decisions about home improvements.

Remember to consult local authorities or professionals for accurate information and abide by applicable tax regulations.

Showcase Your Real Estate Business

Publish your company profile on our blog for just $200. Gain instant exposure and connect with a dedicated audience of real estate professionals and enthusiasts.

Publish Your ProfileRead: Rental Properties and Tax Implications

Relationship between Home Improvements and Property Tax

How home improvements can affect property tax assessment

When it comes to property tax assessment, home improvements play a significant role.

These upgrades can impact the assessed value of a property, which directly affects the property tax amount an owner has to pay.

Home improvements, such as adding an extra bedroom, renovating the kitchen, or building a swimming pool, can increase the value of a property.

Assessors consider these improvements as an indication of a higher property value, leading to an increase in property tax.

Therefore, homeowners should be aware that making significant upgrades to their homes can result in higher property taxes.

Examples of home improvements that may increase property tax

Several types of home improvements are likely to increase property tax assessments.

These improvements usually contribute to the overall value of a property, leading to higher taxes. Some examples include:

- Building an addition: Expanding the living space by adding an extra bedroom, bathroom, or attached garage can significantly increase the assessed value of a property.

- Remodeling the kitchen or bathroom: Renovating these essential areas of a home can enhance its value, resulting in a higher property tax assessment.

- Installing luxurious features: Adding high-end upgrades such as a swimming pool, hot tub, or an elaborate outdoor kitchen can increase the assessed value of a property and subsequently raise property taxes.

Examples of home improvements that may decrease property tax

While many home improvements can increase property tax assessments, there are also some improvements that may have the opposite effect.

These improvements can lead to a decrease in property tax, providing homeowners with potential tax savings. Here are a few examples:

- Energy-efficient upgrades: Installing solar panels, energy-efficient windows, or upgrading insulation can qualify homeowners for tax credits or exemptions, resulting in lower property tax assessments.

- Accessibility modifications: Adding wheelchair ramps, accessible bathrooms, or other modifications to accommodate disabilities can sometimes lead to property tax reductions or exemptions.

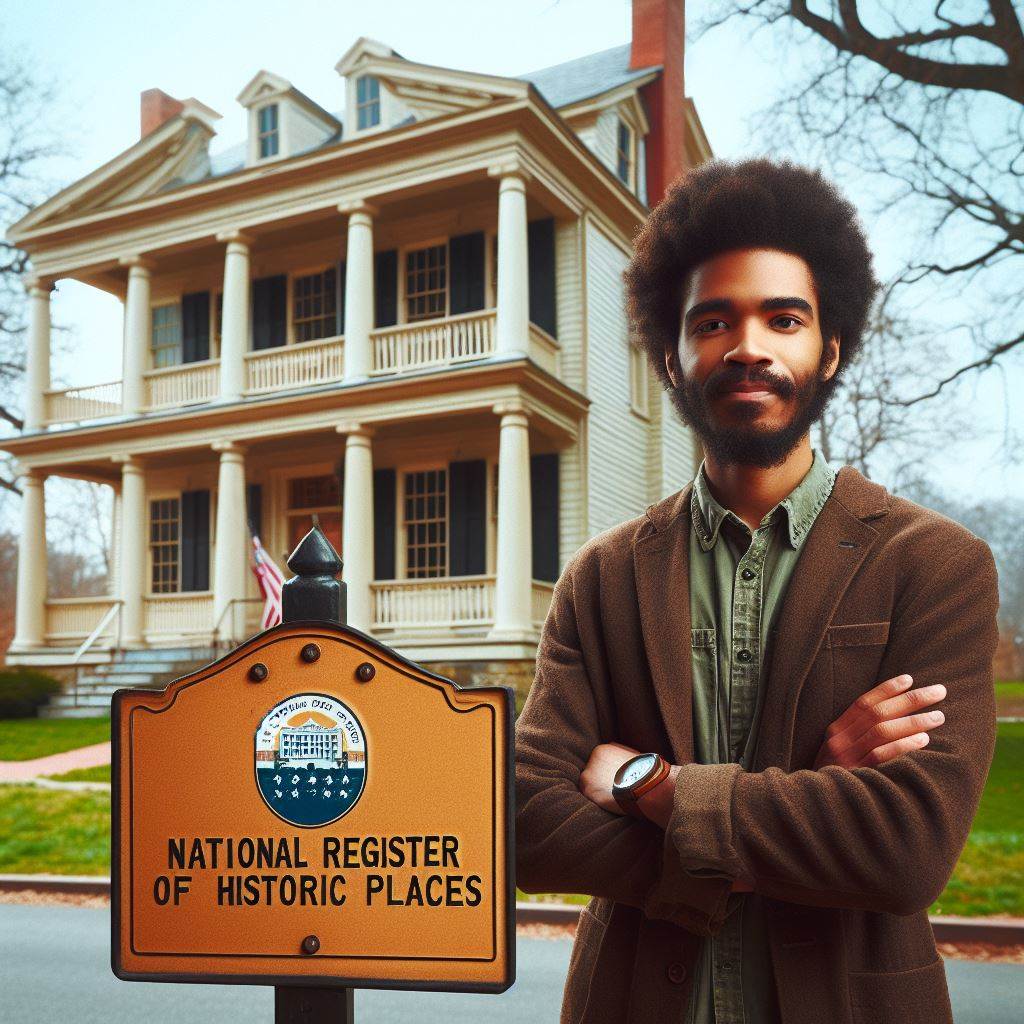

- Historic preservation: If a property is recognized as historically significant, any improvements made to preserve its historic features may qualify for tax incentives or reductions.

In fact, home improvements can have a significant impact on property tax assessments.

Certain improvements, such as building additions or remodeling kitchens, can increase property value and, subsequently, property tax.

On the other hand, energy-efficient upgrades or accessibility modifications may lead to tax savings.

Homeowners need to be aware of these potential effects and plan their improvements accordingly, considering the potential increase or decrease in property taxes.

It is essential to consult with local tax authorities or professionals to understand the specific regulations and tax implications related to home improvements in their area.

By understanding the relationship between home improvements and property tax, homeowners can make informed decisions that align with their financial goals and objectives.

Read: Senior Exemptions in Property Taxation

Tax Exemptions and Home Improvements

Tax exemptions related to home improvements

These tax exemptions are benefits that reduce the taxable value of a property.

Home improvements can potentially qualify for tax exemptions.

Exemptions are usually designed to encourage certain types of property improvements.

They provide financial incentives to homeowners who invest in their properties.

Examples of tax exemptions include exemptions for energy-efficient renovations or historic preservation.

Eligibility criteria for tax exemptions

The eligibility criteria for tax exemptions vary depending on local laws and regulations.

Homeowners may need to meet certain requirements to qualify for exemptions.

These requirements can include property use, ownership duration, or income limits.

Some exemptions may require homeowners to obtain permits or comply with specific building codes.

It’s essential to research and understand the eligibility criteria before pursuing tax exemptions.

Benefits and drawbacks of seeking tax exemptions for home improvements

- Benefits of seeking tax exemptions include potential savings on property taxes.

- Exemptions can help offset the costs of home improvements.

- They encourage homeowners to invest in energy-efficient or historic properties.

- Seeking tax exemptions may also increase the resale value of a property.

- However, there are also drawbacks to consider when pursuing tax exemptions.

- The application process for exemptions can be complex and time-consuming.

- Homeowners may need to provide extensive documentation and adhere to strict guidelines.

- There is no guarantee that all home improvements will qualify for exemptions.

- In some cases, tax exemptions may only provide a temporary benefit.

- Homeowners should weigh the potential benefits against the effort and costs involved.

In short, tax exemptions related to home improvements can provide financial incentives for homeowners.

These exemptions can reduce the taxable value of a property and potentially lead to savings on property taxes.

However, homeowners must meet specific eligibility criteria, which can vary depending on local regulations.

Showcase Your Real Estate Business

Publish your company profile on our blog for just $200. Gain instant exposure and connect with a dedicated audience of real estate professionals and enthusiasts.

Publish Your ProfileWhile seeking tax exemptions can have benefits such as offsetting improvement costs and increasing property value, there are also drawbacks to consider.

The application process can be complex and time-consuming, and there is no guarantee of qualifying for all improvements.

Homeowners should carefully evaluate the potential benefits and drawbacks before pursuing tax exemptions for home improvements.

Read: Condo Insurance: What You Need to Know

Strategies for Managing Property Tax and Home Improvements

Researching and planning home improvements with property tax in mind

- Research and understand how different home improvements can impact your property tax assessment.

- Consider the potential increase in property value and tax assessment after completing home improvements.

- Look for cost-effective home improvement projects that can add value without significantly increasing your property tax.

- Consult local tax authorities or experts to gather information on property tax guidelines related to home improvements.

- Calculate the potential return on investment for each improvement, taking into account the long-term tax implications.

- Explore if there are any tax incentives or exemptions available for specific types of home improvements.

Understanding the local tax laws and regulations

- Research and understand the property tax laws and regulations in your local jurisdiction.

- Take note of the criteria used to assess property value for tax purposes in your area.

- Be aware of any local tax caps or limits that may help control property tax increases.

- Stay informed about potential changes or updates to property tax laws that may affect your calculations.

- Understand the assessment process and how different variables, such as home improvements, can impact it.

Seeking professional advice for navigating property tax implications of home improvements

- Consult with a tax professional or property appraiser to get accurate estimates of the tax implications of your planned home improvements.

- Discuss your goals and budget with the professional to determine the best strategy for managing property tax.

- Ask the professional to assess the potential increase in property value post-home improvements and its impact on tax assessments.

- Consider the professional’s advice on timing the improvements to optimize tax benefits and minimize immediate increases.

- Stay in touch with the professional to address any concerns or new tax regulations that may arise in the future.

By researching and planning home improvements with property tax in mind, understanding local tax laws, and seeking professional advice, homeowners can optimize their investments while managing property tax implications effectively.

Read: Amending HOA Bylaws: A Guide

Conclusion

Recap of the key points discussed

- Property tax is a recurring expense that homeowners should consider when planning home improvements.

- The value of a property can increase after improvements, leading to higher property tax assessments.

- Understanding property tax laws and exemptions can help homeowners save money.

- Homeowners should keep track of their property tax assessments and ensure they are accurate.

Importance of considering property tax when planning home improvements

Homeowners should factor in property tax implications before embarking on costly home improvement projects.

While renovations can enhance the value and enjoyment of a property, they can also lead to higher property tax assessments.

Being aware of this can help homeowners make informed decisions about improvements that align with their financial goals.

Encouragement to explore available resources and seek expert advice on property tax and home improvements

It is essential for homeowners to educate themselves about property tax laws, regulations, and potential exemptions.

Local tax assessors’ offices and government websites offer valuable resources.

Seeking advice from professionals, such as real estate agents or tax consultants, can provide further insights and help homeowners navigate the complexities of property tax and home improvements.

Understanding the relationship between property tax and home improvements is crucial for homeowners to make informed decisions.

By considering property tax implications, exploring available resources, and seeking expert advice, homeowners can optimize their home improvement plans and finances.