Introduction

Property taxes play a significant role in the overall financial obligations of homeowners.

Understanding how these taxes affect your mortgage is crucial for effective financial planning and budgeting.

Property taxes are levies imposed on property owners by local governments to finance public services and infrastructure.

They are calculated based on the assessed value of the property and can vary widely between different areas.

Importance of understanding how property taxes affect your mortgage

Understanding how property taxes affect your mortgage is essential for several reasons.

Firstly, property taxes can significantly impact the affordability of homeownership.

Higher taxes can increase the overall cost of owning a home, while lower taxes can make it more affordable.

Additionally, property taxes are typically included in the monthly mortgage payment made by homeowners.

Lenders often set up escrow accounts to collect these taxes on behalf of homeowners, ensuring they are paid consistently.

An understanding of how property taxes factor into the mortgage payment helps homeowners accurately plan their monthly budget.

Moreover, property tax assessments are subject to change, resulting in fluctuations in the monthly mortgage payment.

Being aware of these potential changes allows homeowners to anticipate and account for any adjustments in their financial planning.

In essence, comprehending how property taxes affect your mortgage is crucial for homeowners.

This knowledge empowers individuals to make informed decisions, enabling effective financial management and ensuring the affordability of homeownership.

Definition of Property Taxes

Property taxes refer to mandatory payments levied by local governments on real estate owners.

Transform Your Real Estate Decisions

Unlock personalized real estate insights crafted just for you. Get actionable advice designed to amplify your success.

Get StartedProperty Taxes as a Mandatory Payment

They are a compulsory financial obligation imposed by local governments on individuals who own real estate properties.

These taxes are collected annually or semi-annually and are used to fund various public services and infrastructure developments.

Failure to pay property taxes can result in penalties or even the foreclosure of the property.

Factors That Determine Property Taxes

- Property Value: The assessed value of the property is a primary determinant of the property tax amount. Local tax assessors evaluate the market value of the property and apply an assessment ratio to determine the taxable value.

- Local Tax Rates: Each local government sets its own tax rate, usually expressed as a percentage of the property’s assessed value. This rate varies depending on the needs and priorities of the local community.

- Exemptions: Various exemptions or deductions may be available that can reduce the property tax burden for certain individuals or properties. Common exemptions include those for veterans, senior citizens, and disabled individuals.

- Special Assessments: In some cases, property owners may be subject to additional special assessments for specific purposes such as road repairs, sewer system upgrades, or school construction. These assessments are typically levied based on the property’s proximity to the improvement project.

Benefits of Property Taxes

- Funding Local Services: Property taxes play a crucial role in funding essential local services such as schools, police and fire departments, public transportation, and park maintenance. These services contribute to the overall quality of life within a community.

- Equal Distribution of Tax Burden: Property taxes are based on the value of the property, ensuring that individuals with more valuable properties contribute proportionately more to the tax revenue. This promotes a more equitable distribution of the tax burden.

- Local Control: Property taxes enable local governments to have control over their own source of revenue. This financial independence allows communities to prioritize their needs and make decisions that align with their unique circumstances.

Considerations for Homeowners

- Budgeting: Property owners should consider property taxes when budgeting for homeownership, as these taxes can significantly impact monthly mortgage payments. Lenders often include property taxes in the escrow account to ensure they are paid on time.

- Tax Appeals: Property owners have the right to appeal their property tax assessment if they believe it is too high. This involves providing evidence such as recent home sales or assessment errors to support the appeal.

- Tax Deductions: In some countries, homeowners can deduct property taxes paid from their annual income taxes, reducing their overall tax liability. It is advisable to consult a tax professional for guidance on specific deductions.

- Tax Planning: It is essential for homeowners to review and plan for potential increases in property taxes. Factors such as local economic growth, development projects, and changes in tax rates can impact property tax assessments.

In fact, property taxes are mandatory payments imposed on real estate owners by local governments.

The amount of property taxes is determined by factors such as property value, local tax rates, exemptions, and special assessments.

While property taxes can be a significant financial obligation, they fund essential local services and contribute to the overall functioning of communities.

Homeowners should consider property taxes when budgeting, explore potential tax deductions, and plan for future tax changes.

Read: Green Upgrades: Impact on Property Tax

Impact of Property Taxes on Mortgage Payments

Property taxes can have a significant impact on your mortgage payments and overall financial situation.

Understanding how property taxes influence mortgage payments is essential for homeowners.

In this blog section, we will provide an overview of how property taxes affect your mortgage and discuss how to calculate property tax expenses as a percentage of monthly mortgage payments.

Overview of how property taxes influence mortgage payments

When you own a property, you are responsible for paying property taxes, which fund local services like schools, roads, and public safety.

These taxes are typically based on the assessed value of your property and vary from one jurisdiction to another.

Property taxes directly influence your mortgage payments because most lenders include the cost of property taxes in your monthly mortgage payment.

Showcase Your Real Estate Business

Publish your company profile on our blog for just $200. Gain instant exposure and connect with a dedicated audience of real estate professionals and enthusiasts.

Publish Your ProfileThey do this by setting up an escrow account, where a portion of your monthly payment is allocated to cover property tax expenses.

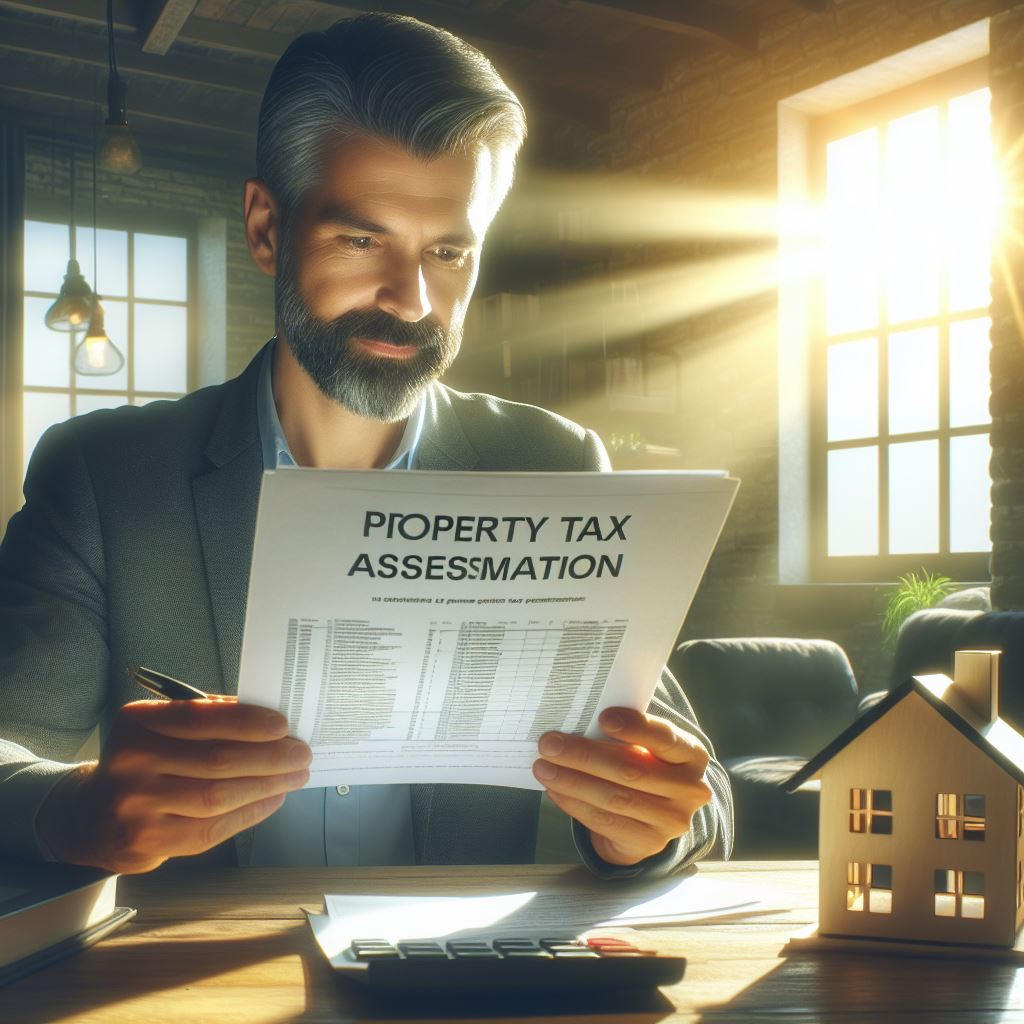

Calculation of property tax expenses as a percentage of monthly mortgage payments

The calculation of property tax expenses as a percentage of monthly mortgage payments depends on several factors, including the assessed value of your property, the tax rate in your area, and whether your loan includes an escrow account.

To calculate this percentage, you should divide the annual property tax amount by the total annual mortgage payment.

For example, if your annual property tax is $3,000 and your total annual mortgage payment is $24,000, the property tax expense would be 12.5% of your mortgage payment.

One benefit of having an escrow account is that it allows you to spread out the cost of property taxes over the year, making it easier to manage your budget.

Additionally, lenders may require an escrow account if your down payment is less than 20% of the property’s value.

On the other hand, if your loan doesn’t include an escrow account, you will need to pay property taxes directly to the local tax authority.

This can be challenging for some homeowners, as they need to budget for these expenses separately and ensure they have enough funds to cover the tax bill when it is due.

Possibility for change in property tax rates

It’s crucial to keep in mind that property tax rates can change over time.

As a homeowner, you should regularly review your property tax assessment to ensure its accuracy.

If you believe your assessment is too high, you can appeal it to potentially lower your property tax bill.

Moreover, if you make improvements to your property, such as adding a new room or renovating your kitchen, it can increase the assessed value of your property, leading to higher property taxes.

Therefore, it’s important to consider these potential tax implications before making significant home improvements.

In summary, property taxes have a direct impact on your mortgage payments.

Understanding how property taxes influence your mortgage can help you plan your finances better and avoid any unexpected financial challenges.

By calculating property tax expenses as a percentage of your monthly mortgage payments, you can have a clearer picture of your overall housing costs.

Regularly reviewing your property tax assessment and considering potential tax implications of home improvements is crucial for maintaining a favorable financial situation as a homeowner.

Read: Property Tax and Home Improvements

Escrow Accounts and Property Taxes

property taxes are an important consideration for homeowners as they can significantly affect your monthly mortgage payments.

Here, we’ll explore how property taxes are managed through escrow accounts and the impact they have on your mortgage.

Escrow accounts are financial accounts established by mortgage lenders to hold funds for the payment of property taxes and insurance premiums.

These accounts act as a buffer for mortgage lenders, ensuring that property taxes are paid on time and that the property remains protected.

Definition and Explanation of Escrow Accounts

Escrow accounts are accounts managed by the mortgage lender where money is deposited to cover property taxes and insurance premiums.

Homeowners contribute to the escrow account each month as part of their mortgage payment, allowing the lender to make timely payments when due.

Importance of Escrow Accounts in Managing Property Tax Payments

Escrow accounts play a crucial role in managing property tax payments as they eliminate the burden of homeowners having to save funds separately for taxes.

By spreading the tax amount over twelve months, homeowners can avoid sudden financial strains when property tax bills arrive.

How Mortgage Lenders Utilize Escrow Accounts to Ensure Timely Property Tax Payments

Mortgage lenders utilize escrow accounts to effectively manage property tax payments by collecting a portion of the annual tax amount each month.

The lender then pays the property tax bills directly from the escrow account, ensuring timely, accurate, and effortless payments.

By maintaining an escrow account, mortgage lenders protect their interests by ensuring that property taxes are paid promptly.

This safeguards their investment in the property and reduces the risk of expensive tax liens or penalties.

Showcase Your Real Estate Business

Publish your company profile on our blog for just $200. Gain instant exposure and connect with a dedicated audience of real estate professionals and enthusiasts.

Publish Your ProfileBenefits of Escrow Accounts for Homeowners

- Predictable Monthly Payments: With an escrow account, homeowners can anticipate their monthly mortgage payments to include property taxes.

- Simplified Financial Management: Eliminating the need to save for property taxes separately, escrow accounts streamline financial planning.

- Protection Against Late Payments: By handling property tax payments, escrow accounts prevent late fees or penalties.

- Peace of Mind: Knowing that property taxes are taken care of can alleviate stress and provide peace of mind to homeowners.

Escrow accounts offer a convenient and efficient way to manage property tax payments as part of your mortgage.

By utilizing these accounts, mortgage lenders ensure that property taxes are paid on time, avoiding penalties and protecting their investment.

For homeowners, escrow accounts provide peace of mind, predictable monthly payments, and simplified financial management.

Read: Rental Properties and Tax Implications

Property Taxes and Loan Qualification

Property taxes are an important consideration when it comes to qualifying for a mortgage.

Lenders take into account these taxes when determining whether you can afford the loan. Here’s how property taxes affect loan qualification:

How property taxes affect loan qualification

Property taxes can significantly impact your loan qualification process.

Lenders consider them as part of your overall housing expenses when assessing your ability to repay the mortgage.

These taxes vary based on the location and value of the property.

How lenders account for property taxes when determining mortgage affordability

Lenders use a debt-to-income ratio to evaluate your financial capacity.

This ratio compares your monthly income to your debt obligations, including property taxes.

They consider the monthly property tax payment, along with other expenses like principal, interest, and insurance.

Impact of high property taxes on loan qualification

If the property you’re interested in has high property taxes, it may affect your loan qualification.

Higher taxes mean higher monthly payments, reducing your affordability.

Lenders may require a higher income or a larger down payment to compensate for these increased expenses.

Advantages of low property taxes on loan qualification

On the other hand, low property taxes can have a positive impact on your loan qualification.

Lower taxes result in lower monthly payments, making it easier to meet the lender’s debt-to-income requirements.

This may increase your chances of getting approved for a mortgage.

Researching property taxes before applying for a mortgage

Before applying for a mortgage, it’s crucial to research the property taxes in the area where you plan to buy a home.

This will give you a better understanding of the potential impact on your loan qualification and help you make an informed decision.

Considering property tax rates when house hunting

When searching for a home, it’s essential to take property tax rates into account.

Properties in areas with higher tax rates may require a larger budget to cover the monthly payments.

Comparing tax rates in different neighborhoods can help you choose a more affordable option.

Understanding escrow accounts and property taxes

Many homeowners choose to have an escrow account to manage their property taxes and insurance payments.

With an escrow account, a portion of your monthly mortgage payment is set aside to cover these expenses.

Lenders typically require this to ensure the taxes are paid on time.

Monitoring property tax changes

Property tax rates can change over time due to various factors like reassessments or changes in local laws.

It’s crucial to stay updated on any changes that may affect your loan qualification.

Increasing property taxes could potentially impact your affordability and budget.

Seeking professional advice

If you’re unsure about how property taxes will affect your mortgage qualification, consider seeking advice from a mortgage professional.

Showcase Your Real Estate Business

Publish your company profile on our blog for just $200. Gain instant exposure and connect with a dedicated audience of real estate professionals and enthusiasts.

Publish Your ProfileThey can provide you with personalized guidance based on your specific financial situation and the property you’re interested in.

In general, property taxes play a significant role in loan qualification. Lenders carefully consider these taxes when assessing your mortgage affordability.

It’s important to research and understand how property taxes can impact your financial situation before committing to a mortgage.

Read: Senior Exemptions in Property Taxation

Strategies for Managing Property Taxes

Property taxes can significantly impact your mortgage payment, but there are strategies you can use to manage this burden effectively.

By understanding various techniques, researching local tax rates and exemptions, appealing property valuations, and considering tax implications when purchasing a home, you can minimize your property tax expenses.

Overview of strategies to minimize property tax burden

- Take advantage of tax exemptions: Familiarize yourself with available tax exemptions, such as those for veterans, seniors, or energy-efficient homes. These exemptions can help lower your overall property tax bill.

- Stay informed about local tax rates: Research the property tax rates in your area to understand how they compare to neighboring regions. This information will give you a better idea of how much you can expect to pay in property taxes.

- Review your assessed property value: Assessments determine the value of your property for tax purposes. If you believe the valuation is excessive, consider appealing it to potentially reduce your property tax burden.

- Keep up with property tax deadlines: Missing property tax payment deadlines can result in penalties and interest charges. Stay organized and ensure timely payments to avoid unnecessary expenses.

- Explore property tax deferral programs: Some areas have deferral programs that allow eligible homeowners, such as seniors or those with disabilities, to delay paying property taxes. Research if this option is available in your locality.

- Invest in home improvements strategically: While some improvements may increase the value of your home, they can also lead to higher property taxes. Consider the trade-off between enhancing your property and potential tax implications.

Researching local tax rates and exemptions

Understanding the local tax rates and available exemptions is crucial when managing your property taxes. Research the following:

- Property tax rates: Investigate the current property tax rates imposed by local authorities. Compare rates among nearby towns and cities to get a sense of the range.

- Exemptions and deductions: Take advantage of any exemptions or deductions available in your area. Check for exemptions related to your age, occupation, energy efficiency, or any other applicable criteria.

- Income-based programs: Some regions offer income-based programs that reduce property taxes for homeowners with lower incomes. Explore whether you qualify for these programs.

- Future tax assessments: Stay up-to-date with future assessments or reassessments that may impact your property taxes. Knowing when your property’s value will be appraised can help plan accordingly.

Appealing property valuations if they seem excessive

If you believe your property valuation is excessive and unfairly increases your tax burden, filing an appeal can be worthwhile. Follow these steps:

- Gather evidence: Collect evidence that supports your claim of an inaccurate property valuation. This may include recent home sales, appraisals, or any significant damage or deterioration that affects your property’s value.

- Review the appeal process: Understand the necessary steps and deadlines for filing an appeal. Familiarize yourself with the documentation required and be prepared to present your case effectively.

- File an appeal: Submit your appeal to the appropriate local authority, usually the tax assessor’s office, following the guidelines provided. Include all relevant evidence and documentation to strengthen your case.

- Attend the hearing: If your appeal goes to a hearing, present your case to the relevant board or panel. Be prepared to answer questions and provide additional evidence, if necessary.

- Accept the decision or pursue further options: Once a decision has been reached, evaluate whether it is satisfactory. If not, you may have the option to further appeal the decision or explore alternative means of relief.

Considering property tax implications when purchasing a home

Property taxes should be a significant consideration when buying a home to avoid unexpected financial strain. Keep the following in mind:

- Research tax history: Look into the property’s tax history to understand its past assessments and any potential increases over time.

- Factor property taxes into the budget: Calculate the anticipated property tax amount based on the purchase price and estimated tax rate. This will give you a clearer picture of your overall homeownership costs.

- Understand local tax policies: Research the tax policies in the area where you plan to purchase a home. Different regions may have varying tax rates and exemptions that can impact your overall tax burden.

- Consult with professionals: Seek guidance from real estate agents, tax professionals, or financial advisors who have expertise in property taxes. They can provide valuable insights and help you make informed decisions.

By proactively implementing these strategies and staying informed about property taxes, you can effectively manage your mortgage and minimize your property tax burden.

Conclusion

Understanding how property taxes affect your mortgage is crucial for homeowners.

By being aware of how property tax rates can fluctuate, homeowners can better plan and budget for their mortgage payments.

It is important to research local property tax regulations and consult with professionals like real estate agents or tax advisors to make informed decisions.

These experts can provide valuable insights and guidance on how property taxes may impact your mortgage in the long run.

Ultimately, being informed about property taxes can help homeowners avoid unexpected financial burdens and ensure they can comfortably afford their mortgage payments.

Therefore, it is highly encouraged that individuals take the time to educate themselves about local property tax regulations.

By doing so, homeowners can make well-informed decisions and have greater control over their finances and homeownership journey.

So don’t hesitate – start researching and consulting with professionals today to understand how property taxes impact your mortgage!